HTML/CSS

html

Many companies will, throughout the life of their business, realise that require to hire financial help. <a href="https

://svwm.co.uk/">Pension planning Oxfordshire</a> can be right at the start of setting up in business because of the

have to have a good financial plan, or further down the road as a result of growth of the company or unexpected

financial problems.<br/><br/>Thankfully, there are a huge number of possibilities available today for any company

that finds themselves in any of the above situations. These can range between adding full-time specialist staff with

their business or hiring a consultant, to seeking free advice from local authorities or buying services from large

financial advisory firms.<br/><br/>For most reasons, including cost and practicality, a favorite choice among

companies today is hiring independent consultants or consultancy firms to meet any financial advisory needs. However,

there are lots of things to consider through the hiring process to make certain that a company gets the outcomes they

want.<br/><br/>The initial thing that any business should ask is what licences, certifications and credentials a

financial advisory consultant has. There are various several types of financial advisors, like the Certified

Financial Planner (CFP), the Chartered Financial Consultant (ChFC), Registered Investment Advisor (RIA) and the

Certified Public Account (CPA).<br/><br/>Each of these credentials is particularly suited to different types and

sizes of business, so an organization must do their research which certification is best because of their specific

needs. Similarly, anyone wanted to hire a consultant specialising in financial advisory needs to inform themselves

about the specific services provided.<br/><br/>As well as learning exactly what services a consultant can deliver,

you should know what they can not provide to their client companies. A small business that knows its needs in detail

before looking for a financial advisory consultant is therefore more likely to find the ideal candidate and service

much quicker.<br/><br/>Another important consideration for companies seeking to hire a specialist in financial

advisory is considering the niche section of the consultant they are considering. If the company has particular

values, such as for example social responsibility, a like-minded advisor with considerable experience in this area is

more likely to be a good match.<br/><br/>Companies may also ask to see a sample financial plan from the consultant or

consultancy firm they're looking at. As each expert in financial advisory includes a different way of working, seeing

an example plan will allow a snapshot of what the truth of working with them can do for a business.<br/><br/><img

width="458" src="https://www.mlmblog.com/wp/wp-content/uploads/2013/11/Money.jpg" /><br/>To give a specific example,

some financial advisory consultants will provide very detailed financial plans, whilst others provides a simplified

and much more easy-to-understand summary of key areas to spotlight. Either of these may meet up with the demands of a

small business, or they could not. In the latter instance, a company will know to check elsewhere for a consultant

more suited to them.<br/><br/>Last of all, an organization should check if they will be working with an individual or

perhaps a team of consultants. Even though one of these options is not intrinsically better than another, many

companies could have preferences in the form of working in their business.<br/><br/>Dealing with a financial advisory

team from the consultancy firm may bring benefits in the form of always having the capacity to maintain touch with

expert help if it's needed, especially in urgent situations. Alternatively, working with an individual consultant can

allow a more intimately knowledgeable relationship to build up between them and the company.<br/><br/>These are just

a few of the important questions that companies should be asking when they are looking to purchase financial advisory

services from a person consultant or a consultancy firm.By evaluating their own specific needs and preferences for a

means of working first, they are able to look for a perfect match and the perfect financial solutions they might need

more rapidly.<br/>

javascript

css

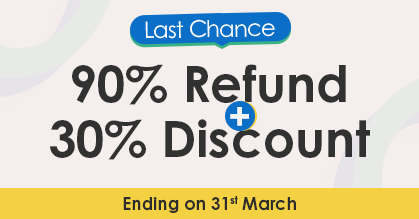

Offers Ending Soon!

Double offers ending soon. Last chance to avail and upskill!